Buyers::::::: Please read the article below. This is very significant information about why to buy now and take the tax deductions allowed!

May 9, 2008

Realty Viewpoint: Show HomeBuyers How Rewards Outweigh Risks

by Blanche Evans

As we've hammered home the point before, Americans have been scared witless by economists, most with personal agendas, that housing still has a long way to go before it hits bottom.

That puts the housing industry in a bad spot. Not only do Realtors, builders and sellers need to convince buyers that now is a good time to buy, the industry also has to go one step further -- prove to buyers that purchasing real estate is a sound investment.

We're assuming that buyers are moving to the sidelines because they're waiting for bargains. But that's not the reason. They're so focused on risk, they're missing out on the rewards.

As a buyer, you get to choose the location, characteristics and price you want to pay. When you sell, you get to take back the equity built, like cashing out a savings account.

But the best benefit is that homeownership, unlike no other investment, is heavily subsidized by the U.S. government in tax relief, which more than offsets most if not all equity losses incurred by falling markets.

From inheriting a house to owning a vacation home to selling a house, Uncle Sam and your friendly local taxing authority lay on the benefits of homeowning so thick, that yearly benefits more than make up for temporary losses in equity. Standard deductions aside, just add up these goodies: mortgage interest payments private mortgage insurance, points paid in purchase and equity loans, property taxes, homestead exemption, capital gains exemptions, and much, much more.

Let's just take one of those. Let's say you lost $4,000 in value on your home during the economic turndown. In that same period, you were able to deduct $12,000 in mortgage interest, the bulk of your housepayment. You're just reduced your taxable income by $8,000. If you're in the 15 percent bracket, you just saved $1,200. Now let's pretend you sold a home, and cleared $20,000. You got to keep all of it without paying the 15 percent. You just pocketed $3,000 in capital gains relief.

Are you beginning to get the picture? As a renter, you get nothing. All you're doing is making your landlord's house payment for him.

So if you're waiting to buy, you're losing money.

Copyright © 2008 Realty Times. All Rights Reserved.

Thursday, May 15, 2008

Tuesday, May 13, 2008

Pictures: Great Dock Canoe Race 2008

Thursday, May 1, 2008

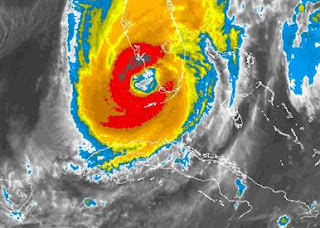

Hurricane Preparedness

Florida mitigation inspections program gets good review

TALLAHASSEE, Fla. – April 30, 2008 – A recent survey of My Safe Florida Home (MSFH) participants revealed that 97 percent of homeowners in the program found the application process easy, 80 percent had a good or excellent experience, and 82 percent were interested in recommending the program to neighbors.

Florida Chief Financial Officer Alex Sink said the program inspects homes and provides grants to homeowners interested in retrofitting their homes to withstand hurricanes. Only single-family homes are eligible for the program, however.

The program, which was relaunched in 2007, provides free wind inspections to homeowners and provides them with recommendations on how to hurricane-proof their homes.

Sink stated that 60 percent of participants learn they are eligible for insurance premium discounts, averaging about $226 in savings. Thirty-four percent of those homeowners took advantage of the discounts without making further improvements to their homes.

Source: National Underwriter (Property & Casualty - Risk & Benefits Management Edition) (04/29/08)

© Copyright 2008 INFORMATION, INC. Bethesda, MD (301) 215-4688

TALLAHASSEE, Fla. – April 30, 2008 – A recent survey of My Safe Florida Home (MSFH) participants revealed that 97 percent of homeowners in the program found the application process easy, 80 percent had a good or excellent experience, and 82 percent were interested in recommending the program to neighbors.

Florida Chief Financial Officer Alex Sink said the program inspects homes and provides grants to homeowners interested in retrofitting their homes to withstand hurricanes. Only single-family homes are eligible for the program, however.

The program, which was relaunched in 2007, provides free wind inspections to homeowners and provides them with recommendations on how to hurricane-proof their homes.

Sink stated that 60 percent of participants learn they are eligible for insurance premium discounts, averaging about $226 in savings. Thirty-four percent of those homeowners took advantage of the discounts without making further improvements to their homes.

Source: National Underwriter (Property & Casualty - Risk & Benefits Management Edition) (04/29/08)

© Copyright 2008 INFORMATION, INC. Bethesda, MD (301) 215-4688

What a wonderful program...especially if you own one of the many 1970's homes here in Collier or Lee County. Free Program.....I love this Country!

Joani Alderuccio RN, BSN, Realtor

Subscribe to:

Posts (Atom)